- QNT is nearing a potential breakout with key resistance at $80.38, supported by bullish sentiment.

- Mixed on-chain signals suggest cautious optimism, with large trades showing bullish interest.

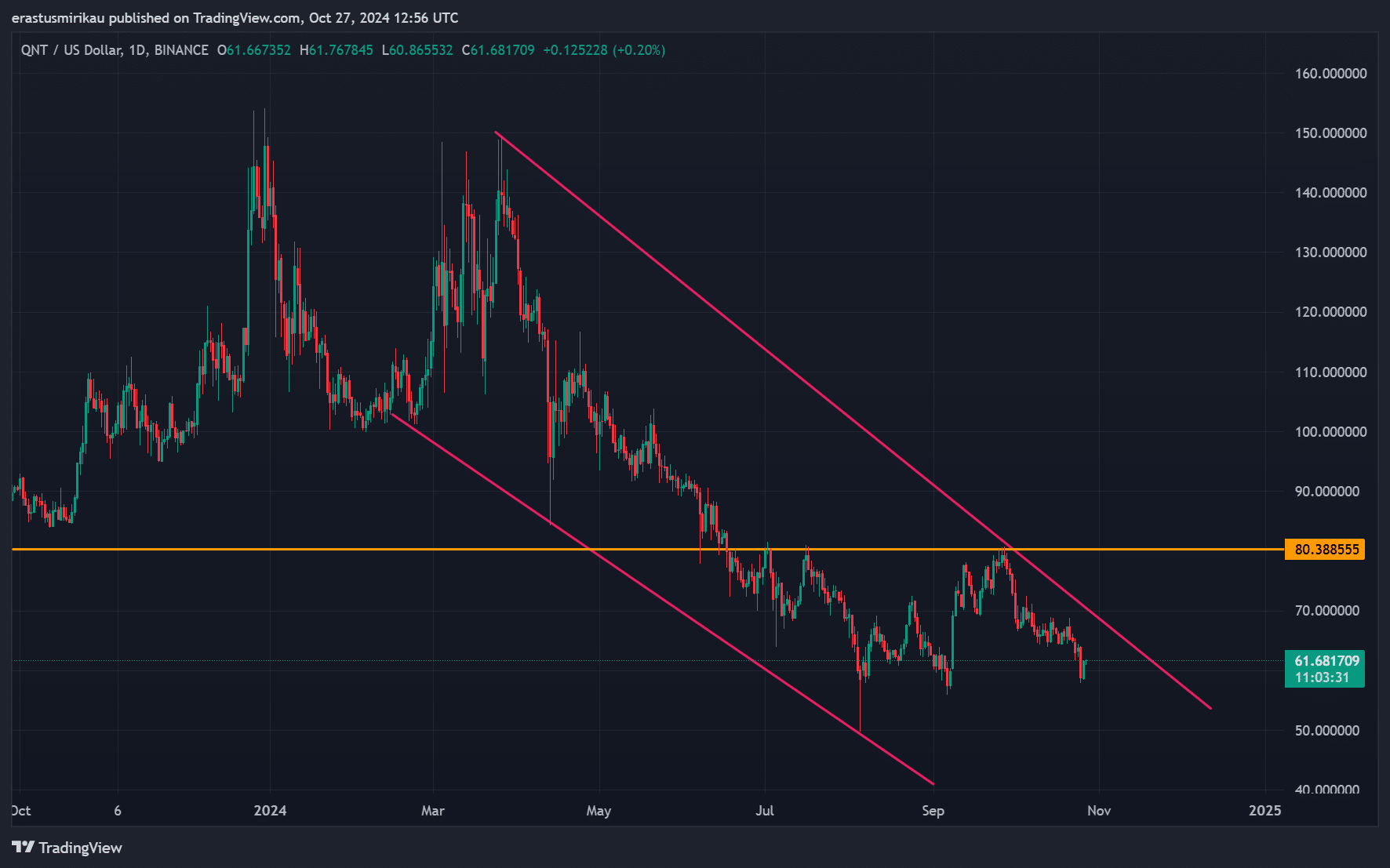

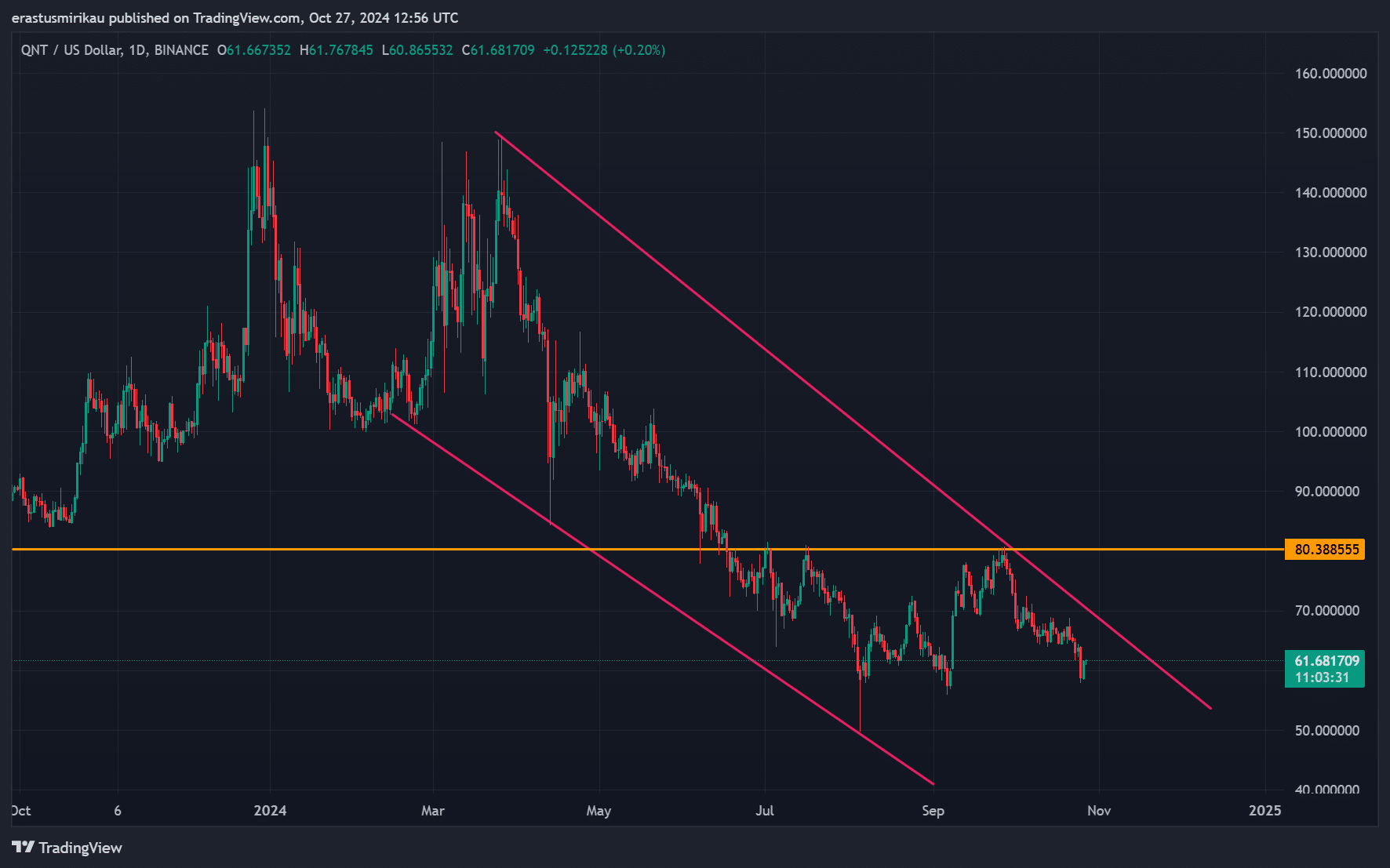

As to [QNT] is on the verge of a crucial breakout, trading in a falling wedge pattern that hints at a possible bullish reversal. This prolonged downtrend appears to be about to end, paving the way for a potential price rally.

Currently priced at $61.65, Quant has gained 3.24% at press time. The key resistance level is around $80.38, which if breached could signal a new uptrend.

Additionally, public sentiment at 0.29 and smart money sentiment at 0.86 both reflect optimistic outlooks, suggesting that market participants are anticipating an upward move. Therefore, future price developments could be decisive for Quant.

Source: TradingView

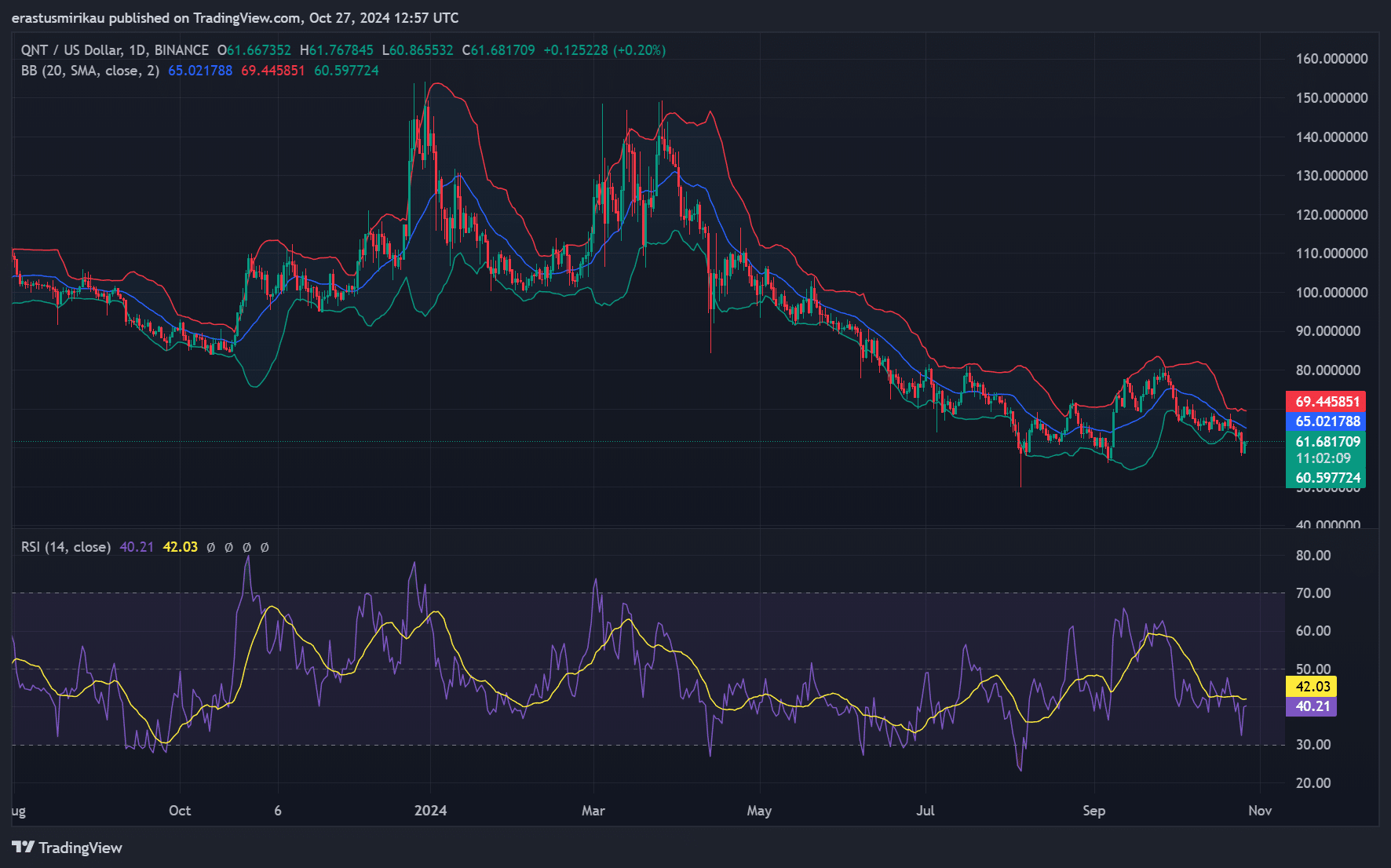

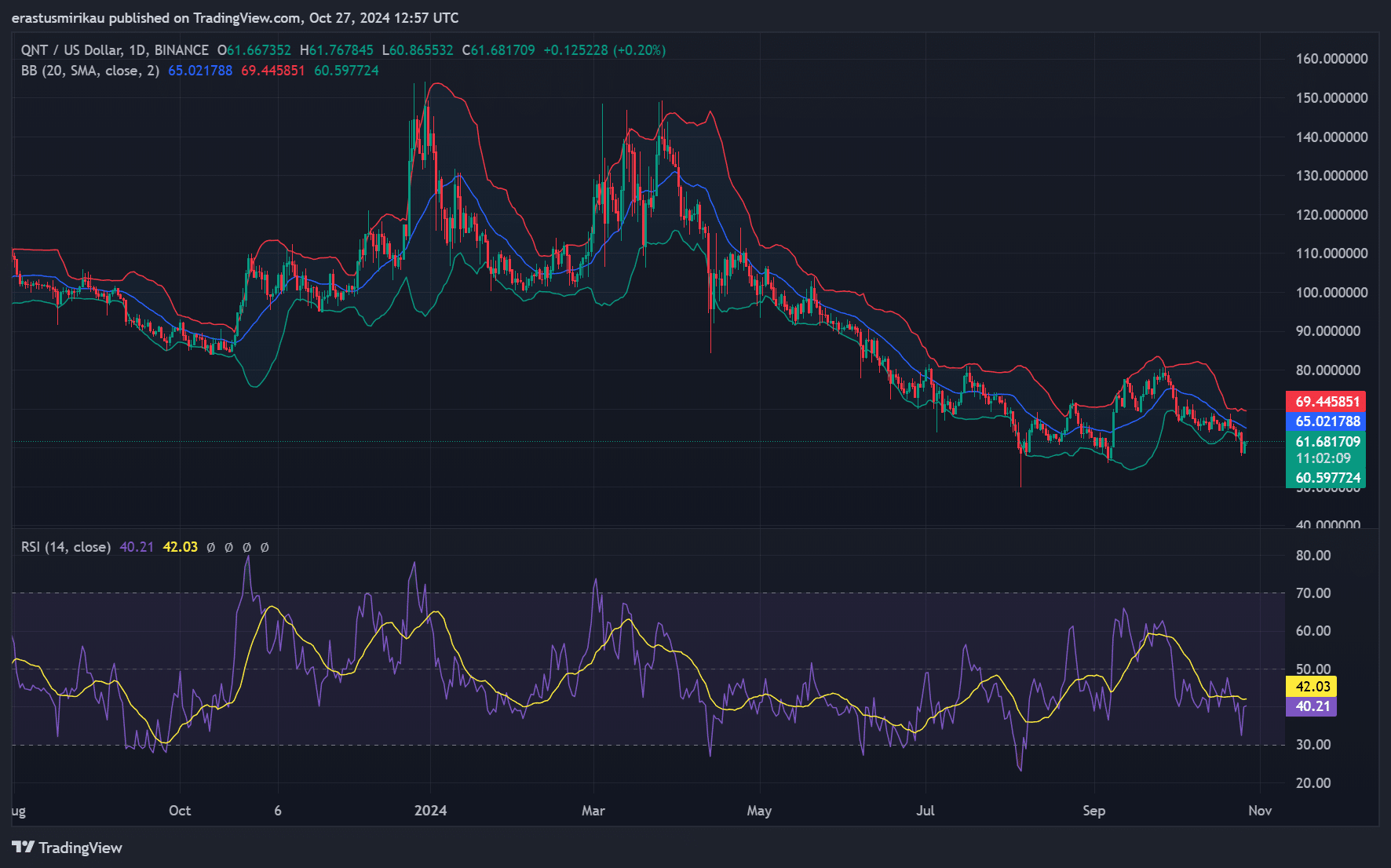

Key Technical Indicators: Bollinger Bands and RSI Add Weight to Bullish Sentiment

Examining QNT’s technical indicators further supports a potential breakout scenario. The Bollinger Bands on the daily chart show that Quant is trading near the lower band.

This position generally suggests oversold conditions, which often lead to a reversal when buyers intervene.

Additionally, the Relative Strength Index (RSI) currently sits at 42, indicating that Quant has just moved out of oversold territory. If the RSI continues to rise, it will likely attract more buying interest, increasing the likelihood of a breakout.

Both indicators suggest that the market is preparing for upward momentum, although breaking resistance remains essential.

Source: TradingView

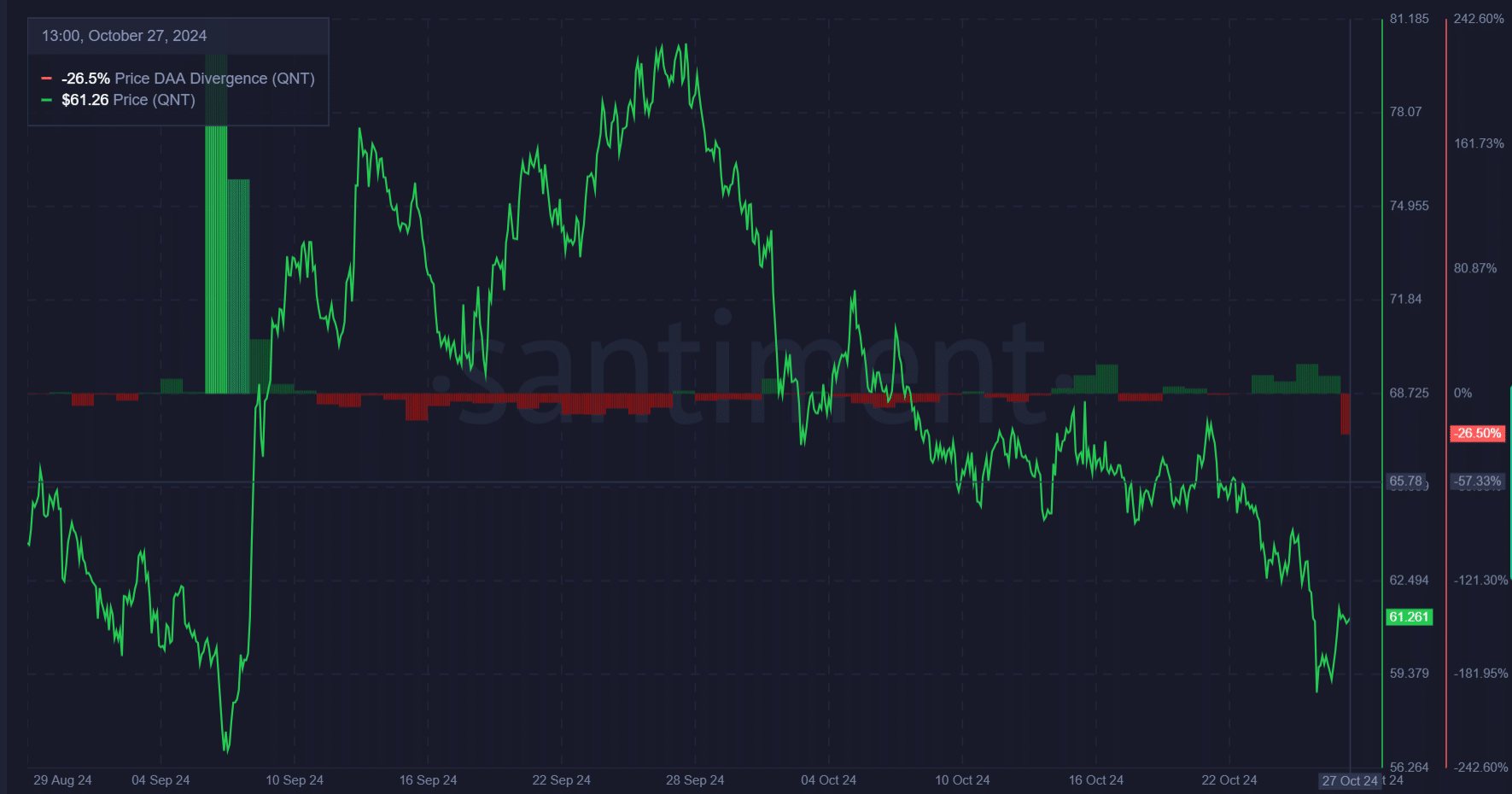

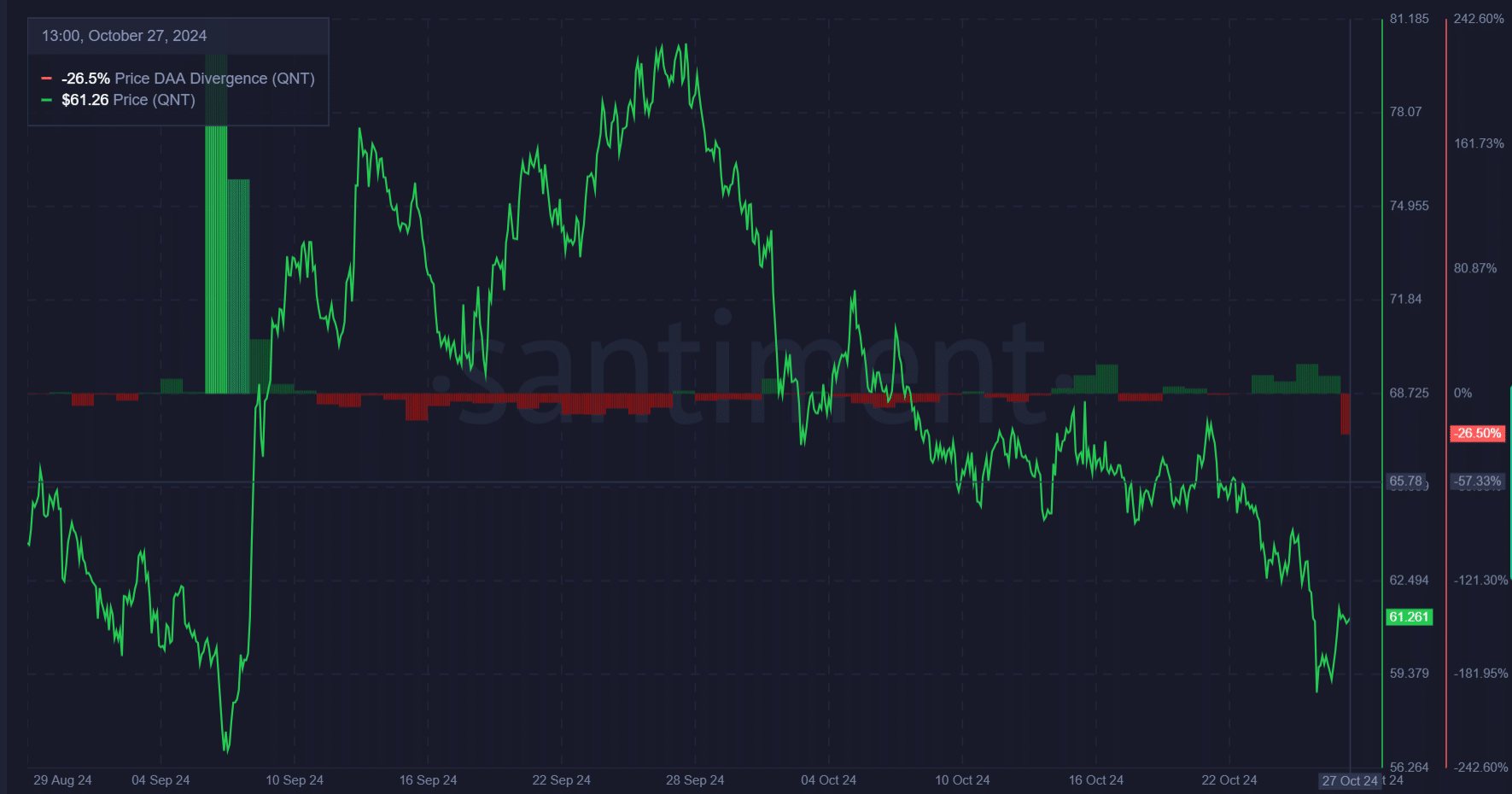

QNT Price and DAA Divergence: Is a Network Boost Needed?

Interestingly, QNT price action shows divergence with daily active addresses (DAA), a key on-chain metric. With a DAA divergence of -26.5%, current network activity lags behind the recent price increase.

This divergence often implies that even if price shows strength, network engagement must catch up to maintain a rally.

Therefore, a reduction in this gap between DAA and price could strengthen the bullish momentum. The alignment of price trends and DAA would promote a stronger foundation for QNT’s potential breakout and reduce the likelihood of a short-lived rally.

Source: Santiment

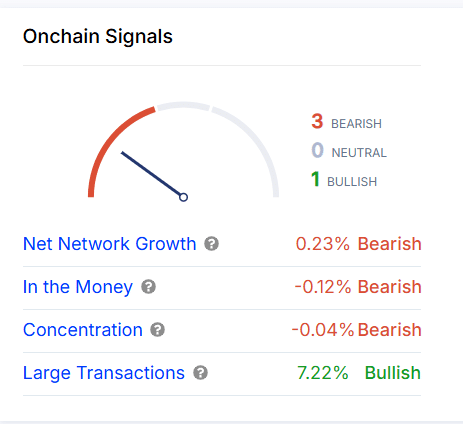

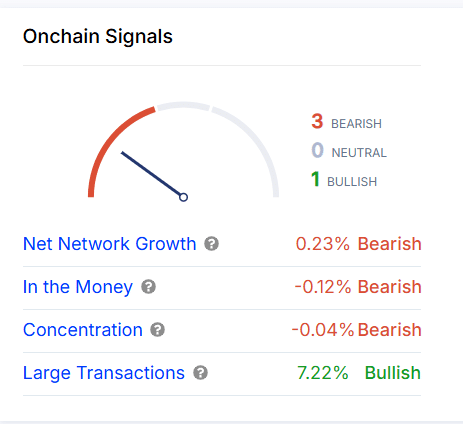

On-Chain Signals: Mixed Indicators, But Bullish Significant Trades

Examining other on-chain signals offers mixed perspectives. Metrics such as net network growth (+0.23%), in-the-money addresses (-0.12%), and concentration (-0.04%) indicate slight downtrends.

However, large trades – up 7.22% – show notable bullish interest, suggesting that larger holders are accumulating. Therefore, this could create a stable base of support, potentially paving the way for more robust price movement if other parameters improve.

Source: In the block

Read the Quants [QNT] Price Forecast 2024-2025

With public sentiment, smart money and technical indicators supporting an optimistic outlook, QNT appears primed for a breakout.

A successful move above $80.38 could trigger a rally, sparking renewed interest in the market. However, aligning on-chain activity with price gains will be key to maintaining any uptrend.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25703346/Scout_EV_Group_0048_Pano.jpg?w=445&resize=445,265&ssl=1)